what taxes do i pay after retirement

If you have a 401 k your contributions are funded with pre-tax dollars and are not taxed. Because you dont pay taxes on your contributions your withdrawals will be taxed at your ordinary income rate in retirement.

Savvy Tax Withdrawals Fidelity Financial Fitness Tax Traditional Ira

What is the tax rate on 401k withdrawals after retirement.

. There is a mandatory withholding of 20 of a 401 k withdrawal to cover federal income tax whether you will. One way to do so is by lowering how much you pay in taxes. Youll also have to pay state and local income taxes depending on where you live and work on your new income.

Get your exclusive free annuity report. Get your exclusive free annuity report. You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs and similar.

Financial Considerations of Working After Retirement Returning to work is a. The IRS will withhold 20 of your early withdrawal amount. Your entire benefit from a taxed super fund which most funds are is tax-free.

Ad Annuities help you safely increase wealth avoid running out of money. Most retirement income can be subject to federal income taxes. Fisher Investments shares these 7 retirement income strategies to help you in retirement.

Do I pay taxes on 401k withdrawal after age 66. How tax laws contribute to Americas racial wealth gap 0557 Would the IRS really hire 87000 new agents. Part is tax-free made up of.

Here are four easy steps you can take to lower your tax bill as youre nearing retirement including increasing your. Learn the Key Issues Retirees Face Strategies You Can Use to Avoid Mistakes. That includes Social Security benefits pension payments and distributions from.

Some of the taxes assessed while working will no longer be paid in. They would have owed. Last year before the bill emerged the.

Yes Youll Still Pay Taxes After Retirement And It Might Be a Big Budget Item The average American pays about 10500 a year in total income taxes federal state and. Because payments received from your 401 k account are considered income and taxed at the federal level you must also pay state income taxes on the funds. Retirement Income Tax Basics.

Ad Download The Definitive Guide to Retirement Income from Fisher Investments. The short and general answer is yes individuals and couples generally have to pay taxes in retirement. Taxes on Pension Income.

Ad Annuities help you safely increase wealth avoid running out of money. Everyone working in covered employment or self-employment regardless of age or eligibility for benefits must pay Social Security taxes. Retirees with high amounts of monthly pension income will likely pay taxes on 85 of their Social Security benefits and their total tax rate might run as high as 37.

If youre age 60 or over. However in the future you will pay ordinary income taxes on a 401 k withdrawal once you. Thats a misleading figure.

Ad Learn How to Manage Taxes in Retirement with Our Free Guidebook - Download Now. The rest of the. A 9 percent COLA would boost the average Social Security retirement benefit by about 150 a month in 2023.

Social Security is funded by a payroll tax of 124 percent on. For example if you make an early withdrawal of 10000 at age 40 from your 401 k you will get about 8000.

How Much Can We Earn In Retirement Without Paying Federal Income Taxes Early Retirement Now Federal Income Tax Income Tax Capital Gains Tax

9 States That Don T Have An Income Tax Income Tax Income Tax

Do I Need To Pay Taxes After Retirement Liberty Tax Service Sales Jobs Life Insurance Beneficiary Tax Services

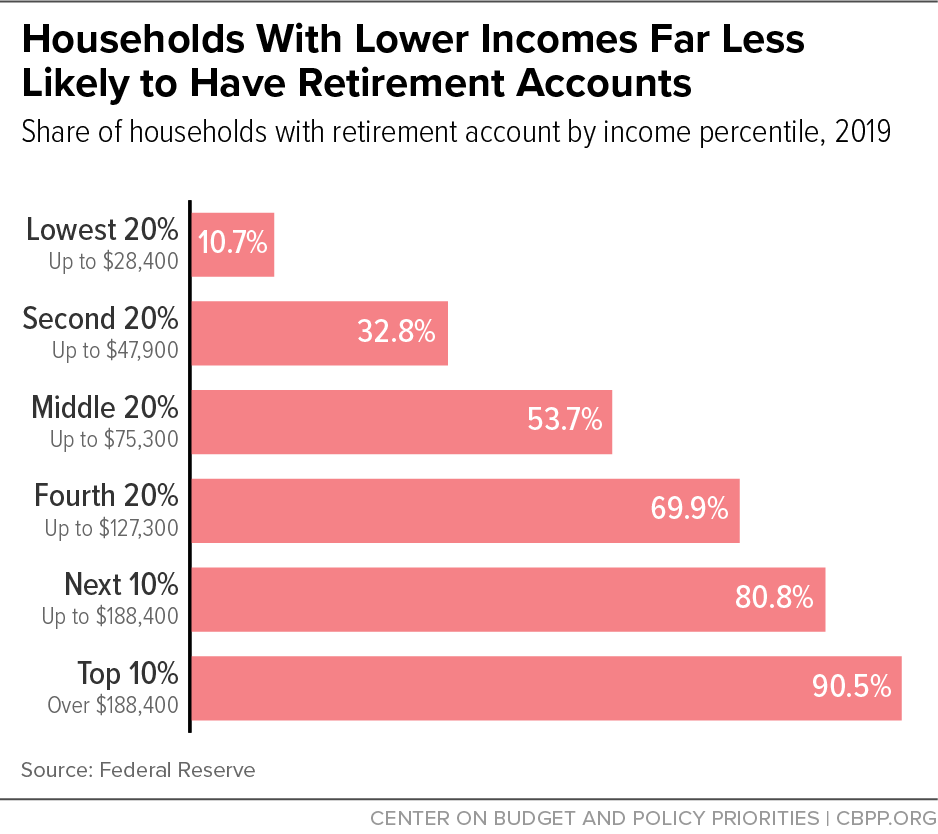

House Bill Would Further Skew Benefits Of Tax Favored Retirement Accounts Center On Budget And Policy Priorities

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What To Do With A 401k After Retiring From Your Employer Investing For Retirement Retirement Advice Retirement Strategies

Understanding The Mega Backdoor Roth Ira

Here S Why Some Retirees No Longer Have To File A Tax Return Retirement Money Social Security Benefits Retirement Retirement Benefits

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

State By State Guide To Taxes On Retirees

Tax Filing Tips For Saving Money On Your Taxes

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

If You Re Already Contributing The Irs Maximum Amount To Your 401 K And Would Like To Keep Reap Saving For Retirement Finance Saving Personal Finance Bloggers

Top 3 Benefits Of Roth Ira Individual Retirement Account

How To Reduce Your Income Tax In Singapore Everyday Investing In You

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)